7 Things You May Want to Know

Home improvement financing is a great alternative to costly mortgage refinance options or for customers without the cash on hand for large projects. It also creates more options for your customers and sales opportunities for your business. If you’re new to offering financing or considering becoming a dealer, check out these frequently asked questions and answers. If you have any questions, please let us know!

How does in-house financing help home improvement companies?

Most home improvement financing companies offer fast or instant credit approvals, which can speed up project start dates. Offering financing also means your customers can make low monthly payments instead of having to procure the entire project’s funds up front. Breaking down payments over the course of up to 20 years means your customer can afford material upgrades, increasing your average project size.

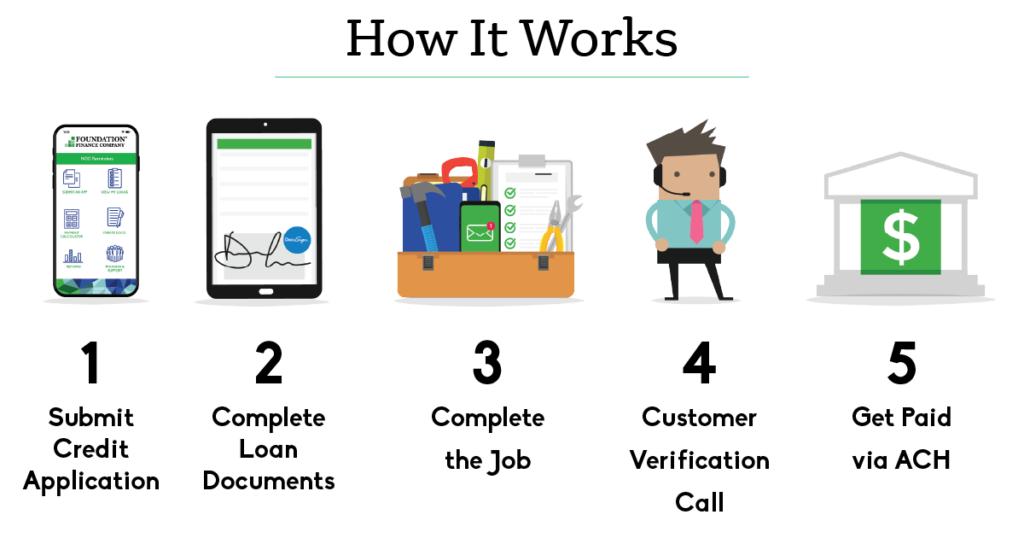

How do I offer financing?

Foundation Finance’s simple financing process is designed for busy contractors. Start by becoming a dealer, then either start an application in the LaunchPAD dealer portal or send customers your custom credit app via text, email or put it on your website. We’ll review their application and reach out to you with a financing decision. Learn more about how it works here!

What kind of support is available?

Financing is easy, but we offer live webinars, one-on-one training, recorded videos and on-demand support for any questions you have. Find our training options here or contact dealer support at 1-855-241-0024 ext. 5012 for additional information.

What industries does Foundation Finance serve?

We cover a wide range of projects and industries with a home improvement focus. Some of the many fields we offer financing for include windows, roofing, siding, water treatment, HVAC, turf and remodeling. Learn more about our markets served here.

How much does offering financing cost?

Joining our dealer network and offering select promos, such as reduced APRS, is free. We also offer a variety of optional promotions you can offer your customers for an additional fee.

Which customers qualify for financing?

Foundation Finance is a full-service home improvement financing lender helping customers with a wide range of credit profiles. Our second look financing process considers a variety of factors including an individual’s credit score and application details to offer a higher approval rate for your customers.

How do I become a dealer?

Enrolling with Foundation Finance is free and easy! Just follow these simple steps.

- Click the “Become a Dealer” button on our Dealer Info page to access the enrollment application.

- Fill out some basic information about you and your company. This should take around five minutes.

- Submit your application. We’ll review it and get back to you in the next couple business days.

Enroll in the Foundation Finance dealer network. Contact us for more info: 1-855-241-0024, [email protected].